The Founder

Trap

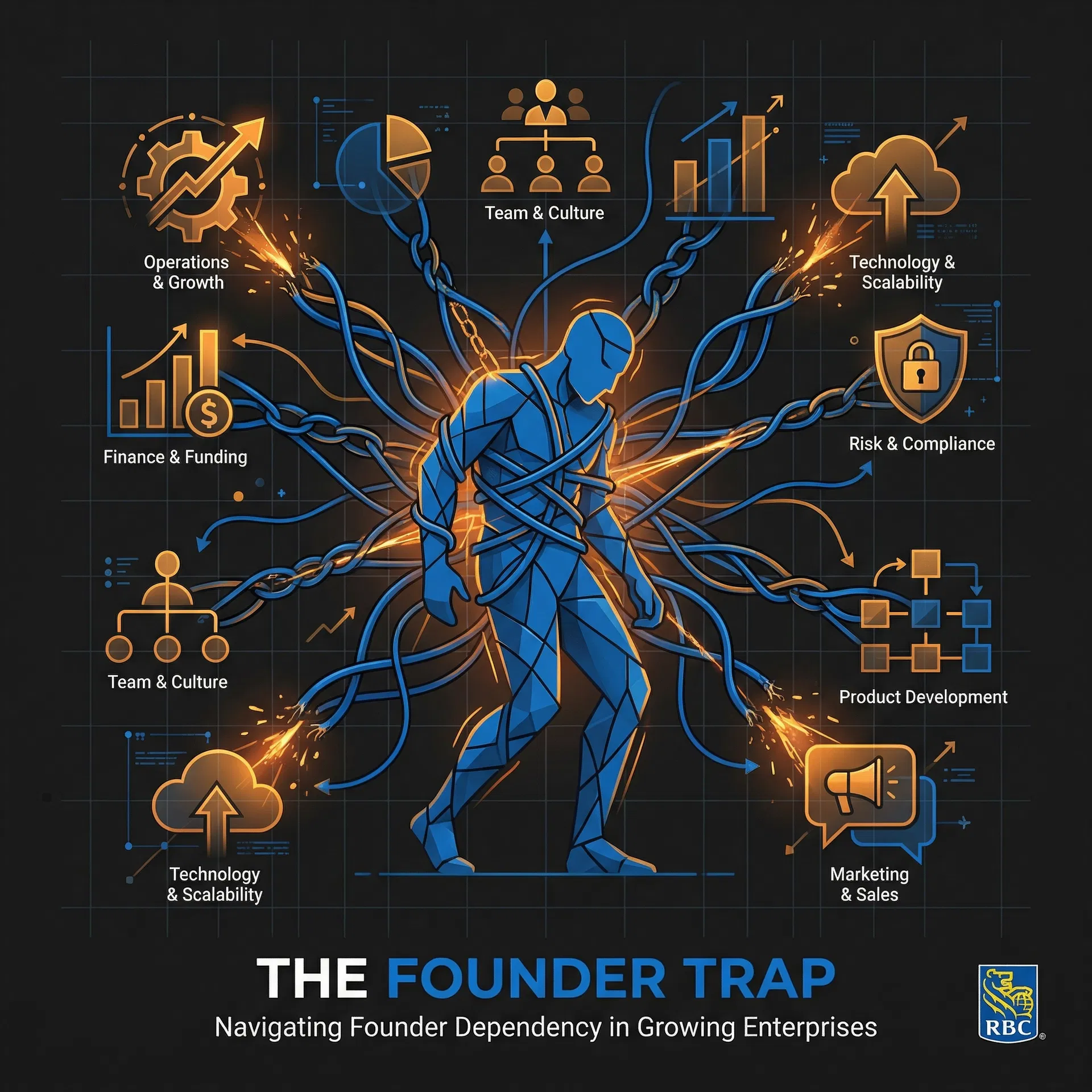

SMEs often hit growth plateaus when the founder remains at the center of all decisions. Traditional credit assessments miss these critical operational maturity signals.

What is the Founder Trap?

The founder trap occurs when a company's success and operations rely disproportionately on a single person — typically the founder or owner. This concentration creates systemic risks that limit growth, reduce company value, and complicate financing or M&A transactions.

Traditional banks primarily assess financial statements, collateral, and credit history. However, these metrics don't reveal whether a company can grow sustainably without its founder — a critical factor for scalability and M&A readiness.

The Cost of the Trap

Stagnant Growth

Market share lossThe company cannot grow beyond the founder's capacity. Opportunities are missed because all decisions flow through one person.

Reduced Value

30-50% discountPotential buyers apply significant discounts (30-50%) for key person risk. Valuation multiples are compressed.

Limited Talent

High turnoverTalented employees leave due to lack of autonomy. Senior executive recruitment fails because they have no real decision-making power.

Difficult Financing

High cost of capitalBanks and investors hesitate to finance a company where everything depends on one person. Credit terms are less favorable.

Inefficient Operations

Compressed marginProcesses are not documented. Decisions are made ad hoc. Operational capacity cannot be replicated or scaled.

Systemic Risk

Existential riskIllness, burnout, or founder departure creates immediate crisis. No viable succession plan. Business continuity compromised.

Why Traditional Assessment Misses This

Financial statements don't reveal operational risk: A company can show revenue growth and healthy profitability while relying entirely on the founder for sales, operations, and strategic decisions.

Collateral doesn't measure scalability: Tangible assets say nothing about the organization's ability to operate autonomously or grow without the founder.

Credit history doesn't predict resilience: A good payment record doesn't guarantee the business will survive if the founder leaves or becomes unavailable.

Financial projections ignore operational constraints: Growth forecasts often assume current capacity can be scaled, which is false if everything depends on one person.

The Organizational Maturity Spectrum

L1: High Concentration

Founder involved in all decisions. No effective delegation. Undocumented processes. High risk.

L2: Emerging Structure

Some functions delegated but founder remains bottleneck. Partially documented processes. Moderate risk.

L3: Ready to Scale

Functional management team. Documented processes. Established governance. Demonstrated growth capacity. Low risk.

L4: M&A Ready

Institutional organization. Robust systems. Distributed leadership. Proven growth capacity. Institutional grade.